Macro & Market Snapshot: Global Markets, DeFi Resilience, Implied Volatility

Welcome to the first in a series of Macro & Market Snapshots provided by Basis Markets DAO.

These updates are designed to give an insight into the global forces shaping the world of macro, markets, futures and flows right now, as well as a deep-dive into key topics and a quick-fire update on DAO activity.

TL;DR

- Interesting time in global markets, with inflation coming under control in most developed countries, bond yields at their highest levels since the Global Financial Crisis, but the makings of a "soft landing" encouraging a largely unexpected market rally, led by large cap growth stocks and AI. Liquidity regime could be changing course.

- Crypto markets seem to be in a period of decoupling from the global indices in the past month (not in the good way), with recent positive news events failing to push the Bitcoin price above the 30,000 USD level, whilst Open Interest falls and price sees little positive action.

- DeFi has seen a period of consolidation since it's peak in 2021-22, with Total Value Locked reaching stability around $40-50bn. The space was shaken by the recent drama surrounding Curve Finance, and whilst this is a huge blow to DeFi and volumes, it seems to have had a muted effect on total TVL. Yields are now sitting at around 3-4%.

- The Basis Markets DAO continues to push forward, with development of the BTX moving towards wider release, as well as a new platform for NFT registrations, discord access live, and an upgraded DAO voting platform nearing completion.

- Upcoming activities for the DAO include voting on Proposals 005 (BTX fee levels & DAO quorum) and 006 (BTX release & marketing approach, including referrals & ambassadors), which are currently with the DAO for review following development & discussion within the community.

Macro Environment

The International Monetary Fund (IMF) put it neatly this month, when it described "near-term resilience, but persistent challenges" in the world economy. This sentiment is echoed by many, who are weighing up significant forces and tensions on both sides of the growth debate.

On the one hand, most economies are showing success in taming inflation. Global headline inflation is expected to fall from 8.7 percent in 2022 to 6.8 percent in 2023 and 5.2 percent in 2024 (although underlying, "core", inflation if projected to decline more gradually). Furthermore, investors are showing belief in global indices, with US nearing all-time highs, and some European markets hitting these, despite much of Europe technically being in a recession. Generative Artificial Intelligence and the largest 7 mega-cap tech stocks in the US have dragged up indices globally, which poses a risk, with valuations at historically high multiples. Many are now predicting a "soft landing" in the US with higher probability, which could set the stage for global economies to follow suit.

On the other hand, the rise in central bank policy rates to fight inflation continues to weigh on economic activity, impacting and likely to continue impacting companies and consumers with debt in particular. Whilst Covid-19 is now no longer classified as a "global pandemic", there continues to be a risk, and the Russia-Ukraine conflict is yet to reach a conclusion. An increase in tension between the West and East regarding global trade and potential conflict in Taiwan continues to bubble under the surface and pose a risk.

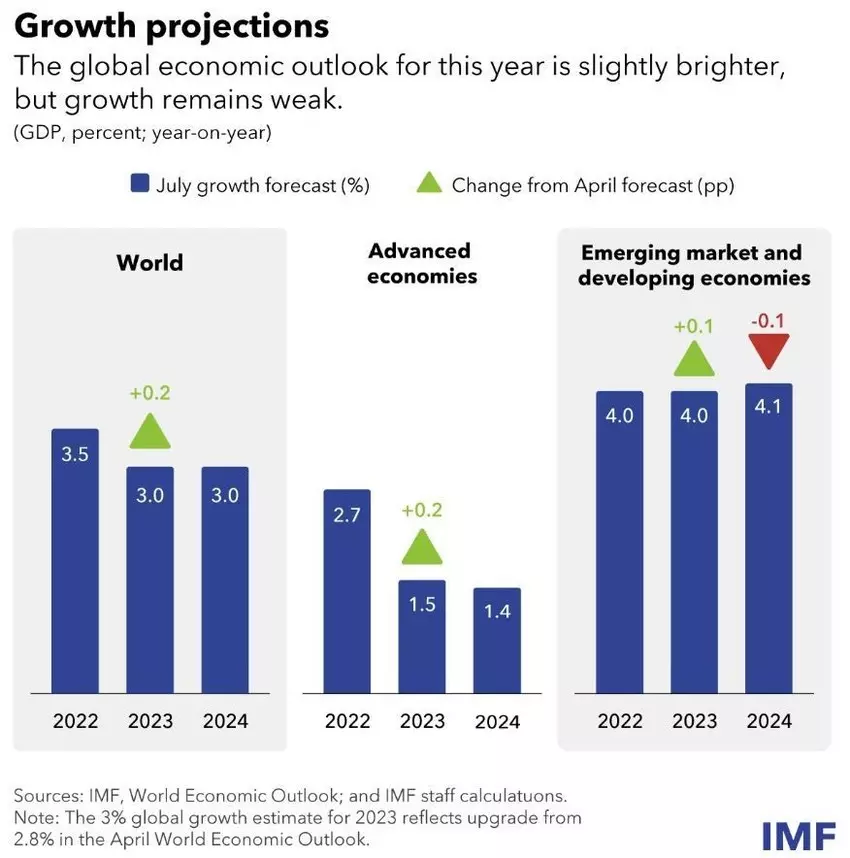

Overall, the IMF expects global growth is projected to fall from an estimated 3.5 percent in 2022 to 3.0 percent in both 2023 and 2024. What this means for markets is another matter, since GDP/markets are correlated but can diverge in direction for longer than many expect.

Another important consideration is global liquidity, which has been supportive of risk-on assets during the first half of 2023, including equity and crypto markets. It looks like this regime could be shifting, led by US monetary policy (which tends to have a knock-on effect worldwide).

Since the agreement for the Fed to issue fresh debt, this has largely been short-dated and to date has been absorbed by the reverse-repo market in the main part. However, the debt issuance planned for H2 2023 is longer-dated and, alongside continuing high rates, may be less likely to be covered through reverse-repo absorption.

As such, the continuing of rising rates and quantitative tightening could lead to flat or decreasing liquidity which in the past has been seen to negatively impact risk-on markets. None of these effects are set in stone, especially in today's unusual global market, but history often rhymes, even if it doesn't repeat.

Crypto Markets

Crypto markets seem to be in a period of decoupling from the global indices (not in the good way), as the push higher in equity markets hasn't fed through to crypto market cap recently.

There have been significant positive news events in Q2 2023, with a case in point being the BlackRock ETF filing and Larry Fink comments. Whilst this seemed to help push Bitcoin above the $30k mark, momentum has since dwindled despite a regular flow of seemingly crypto-positive news. These have failed to push the Bitcoin materially above the $30k USD level and price is seeing little positive action.

With the wider macro picture being one of cautious optimism, crypto-natives will hope we see a regaining of the macro-crypto correlation to the upside, rather than to the downside.

State of DeFi

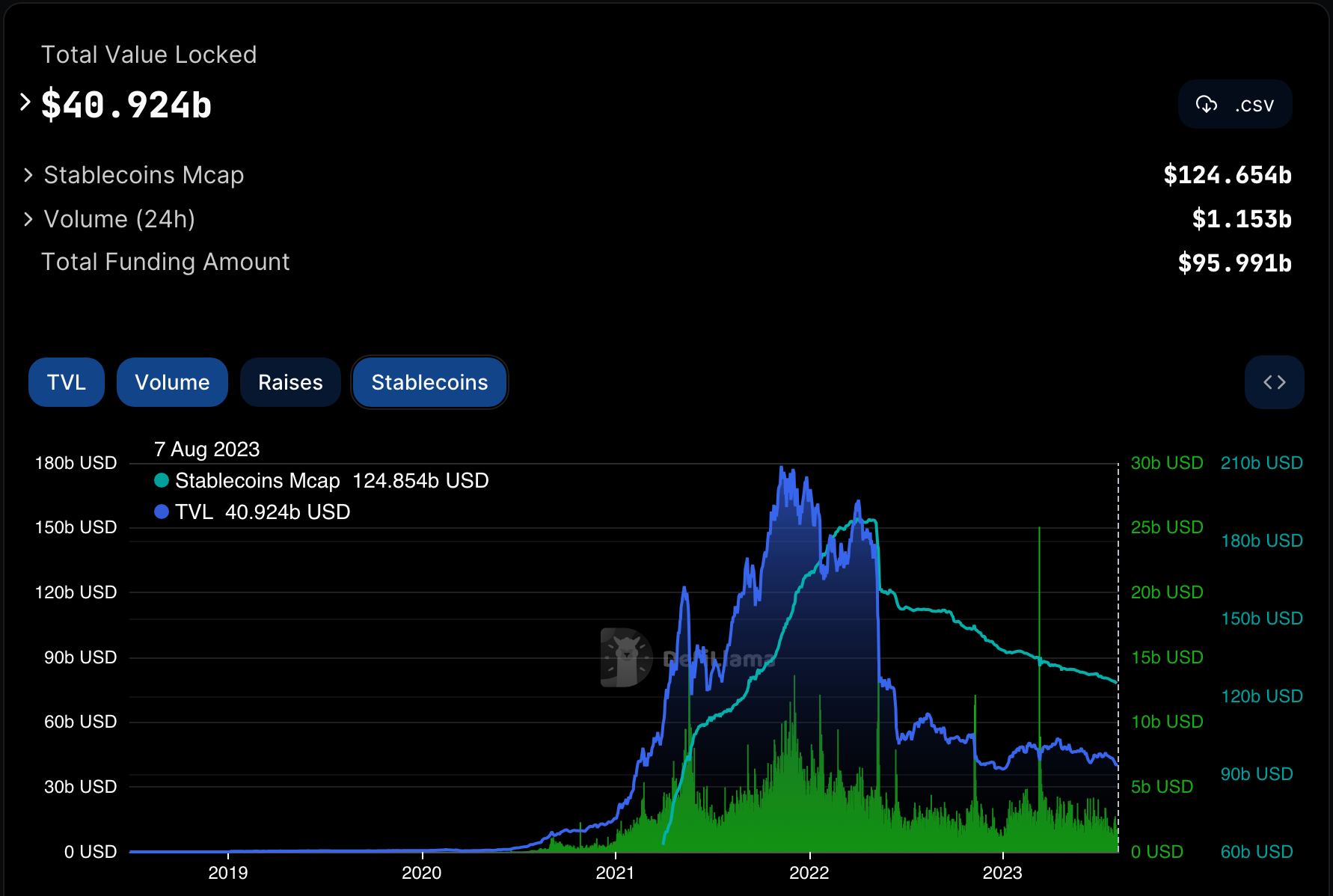

It has been a turbulent ride since DeFi came to the fore in 2020, but DeFi seems to have found stability over the last 12 months... in market size terms at least! The DeFi space saw a huge rise in Total Value Locked (TVL) over 2021-2022. Over $100bn was locked in protocols for approximately 1 year, peaking at $180bn.

However, this did not last after the initial boon, with huge losses in mid-2022 along with market direction. The level of TVL has remained relatively stable since then, though, with between ~$40-50b TVL across chains for over a year now. This shows that people are willing to keep assets on-chain, despite some huge shocks to confidence such as the FTX collapse, which one could have predicted might precipitate a larger drop in DeFi TVL.

Now yield, unfortunately, is different question. Whilst we have seen TVL stabilise, DeFi yields have continued to fall. 30d average yields are now 3-4% per year, which might explain the continued slightly-negative trend in TVL. Stablecoin market cap continues to drift gently lower.

Yield comes from a number of different sources. Many projects issuing yield in native token, so a rising market for tokens created the illusion of hugely profitable yield, which has not been sustained. As crypto comes to it's next cycle, projects in the next wave need to work out how to provide sustainable yield to users to incentivise continued allocation. This is a very difficult hurdle; some commodities markets are still seeing these cycles 120 years later.

One source of sustainable yield comes from funding rates, which is why Basis Markets' products are focussed on supporting users to understand, identify and execute their own delta-neutral trades to take advantage of these yields, which have historically been available no matter the period or price action.

Opinion: Crypto Volatility

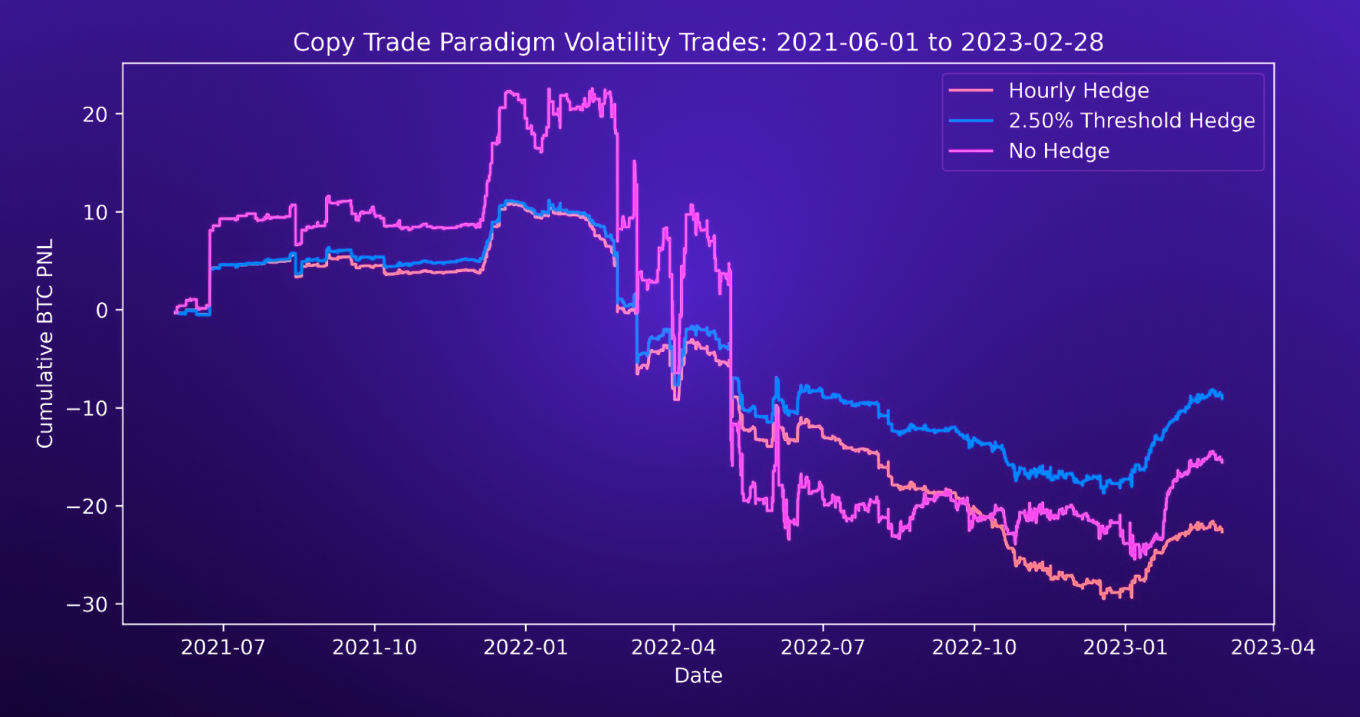

This chart shows the cumulative return on PnL for volatility trades on Bitcoin since the 2021 bull market. The is one of the most telling charts I have seen in many years. Circa 50% loss on PnL for BTC volatility trades is a staggering loss for market participants. You can safely assume that these are considered the sophisticated trades in the sector. Fully delta hedged and rolling to a specific program, yet a 50% top to bottom drawdown. This is down to one very simple reason: a lack of any significant buying of upside calls.

The entire crypto options space was bolstered by participants buying hugely overpriced upside calls. The demand for 80k & 100k BTC calls was endless, so much so that the volatility quoted for a 2 week 80k BTC call in early November 2021 was 180%, this made the option a 35 delta option! In simple terms, this means the market priced the chances of BTC going from 65,000 to 80,000 in 2 weeks as a 35% chance. The scary part is not the pricing, it is that people bought these, a lot of these. This provided any volatility options traders with opportunities for significant income. Income they would need during the dark times ahead.

You will note that we are seeing an uptick in the profitability of the vol trader during 2023. Realistic pricing of the upside has forced models to act sensibly. But overall, IV (implied volatility) has remained low. People are no longer expecting the heady days of 2021 any time soon.

The key to highly functioning markets is balance, these periods of balance need to enable people on both sides of the price to be able to conduct business. The last 6 months of Volatility pricing has provided that, let’s hope it continues.

Market News

A selection of recent news pieces:

- Macro commentators at Morgan Stanley advise caution going into H2 2023, based on three key factors including bond market turbulence. Link.

- DeFi shows its resilience despite significant stress test in the form of Curve-Vyper hack. Link.

- Grayscale, the world's largest Bitcoin Trust sees potential in a continued crypto recovery, tied to expected US 'soft landing'. Link.

- Venture capital firm, Sequoia Capital, has cut its cryptocurrency fund by over 65% from $585 million to $200 million. Link.

- MicroStrategy's bitcoin position back in profit as it continues to increase its bitcoin holdings fuelled by 2023 share price rise. Link.

- KPMG published a report that underscores how Bitcoin can contribute to the three pillars of ESG: environmental, social, and governance. Link.

Education: Basis Trading

The delta-neutral trading of perpetual futures instruments to capture funding rates on crypto exchanges remains the focus of Basis Markets.

The BTE is seeing continued use by NFT holders, as is the BTX, with feedback from beta testers feeding into ever-increasing stability and functionality.

Alongside these products, education is a critical pillar of the Basis Markets DAO, supported by the community which contributes actively within the Discord.

Users can find the first part of a series of educational videos demonstrating the BTX on the Basis Markets YouTube channel.

DAO Updates

#BTX version v0.3.9-beta is live!

— basis.markets (@basismarkets) July 17, 2023

- UI updates

- borrow data

- bug fixes

- execution improvement

- streamlined opportunities page

v0.4.0 is coming 🤜🤛 pic.twitter.com/Ir2Cw5AaU5

- A new secure platform for NFT registrations for access to the Basis Trade Engine is now live here.

- Automated discord access is now live for NFT Holders, linked to NFT registrations and BTE access here.

- The first in a series of educational videos on the BTX has been released for community members on the Basis Markets YouTube channel.

- The BTX continues active development to improve stability, execution performance, and user experience. Weekly updates for DAO members are released for NFT Holders in the Basis Markets Discord.

Thank You

The Basis Markets DAO is lucky to have contributors from across the market landscape within its community. As the first in this series, we'd love to hear what you think and get feedback for what you'd like to see covered in these Snapshots going forward.

Please head over to the Basis Markets Discord to join the conversation and contribute!

Disclaimer

Please see the Basis Markets Terms of Service for full details.

NO INVESTMENT ADVICE: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice, Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Basis Markets DAO or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Basis Markets DAO is not a fiduciary by virtue of any person's use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Basis Markets DAO, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS: There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains and losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security's or a firm's past investment performance is not a guarantee or predictor of future investment performance.