Macro & Market Snapshot: Macro Environment, Crypto Markets, DAO Updates

Welcome to the latest Macro & Market Snapshot provided by Basis Markets DAO.

These updates are designed to give an insight into the global forces shaping the world of macro, markets, futures and flows right now, as well as a deep-dive into key topics and selected opinions.

There has been a lot of activity in the DAO since the last Snapshot, so we’ve also included a quick-fire update on the latest developments. As always, head over to the Basis Markets Discord for more.

TL;DR

- 2023 continues to be a volatile year, with asset markets adjusting to lower global liquidity, bond market volatility, and Middle East volatility, against a backdrop of easing inflation, higher real rates and a global earnings recession.

- Good news on inflation, job data, and growth projections signalled a "soft landing" could be possible, but the latest signs of "higher for longer" rates and manufacturing stagnation suggest that challenges remain.

- It's possible that a bounce back in earnings in Q4, going into 2024 paired with the start of lower real rates could provide a stable footing for stability and growth going into the new year.

- Crypto markets have been quiet, waiting for news on Spot ETF approvals and the May 2024 Bitcoin halving as catalysts for volume and price action. This, along with wider risk-off sentiment has propelled Bitcoin's dominance.

- Crypto development activity has seen a downturn since the start of the "bear market", but certain ecosystems like Solana have taken the opportunity to continue building and launching significant new features.

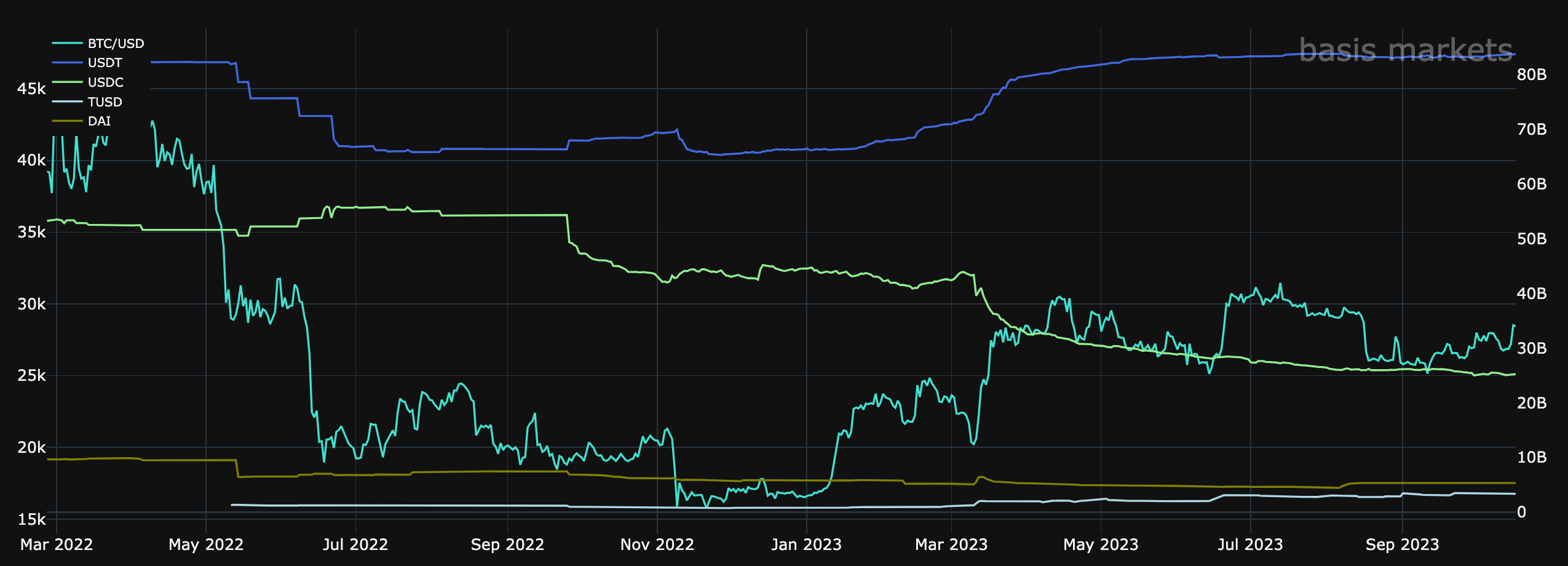

- DeFi yields are struggling to beat real yields in traditional market, which, coupled with hesitant user sentiment since 2021-2022's hacks and failures, has hurt Total Value Locked, although this looks to be stabilising.

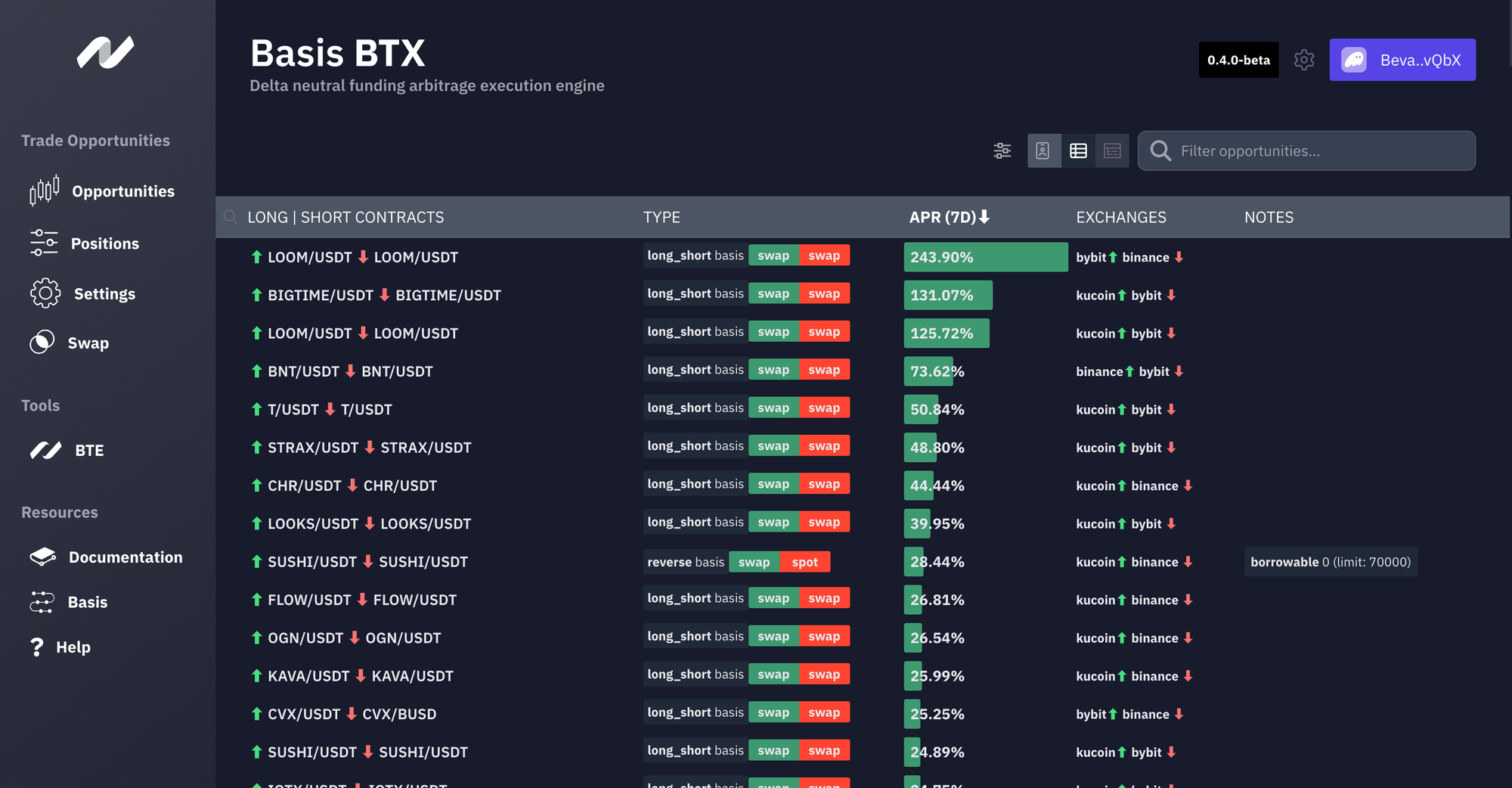

- Delta-neutral CEX returns remain attractive, and keep offering stable opportunities as well as shorter-lived but higher yield opportunities. With active development and regular releases to the BTE and BTX, Basis Markets DAO remains the best place for analysing and capturing these yields.

- DAO updates have been coming thick-and-fast, with significant improvements in the BTX on the path to public release, a new DAO platform, refreshed product documentation, Proposal 005 underway, bug fixes, performance improvements, and significant overhauls of back-end data flows.

Macro Environment

The year 2023 has surprised markets in many ways, and Q3 has continued this trend. We’ve seen a correction in major global indices, bond prices surging to their highest levels in 25 years, oil nearing Saudi Arabia’s $100 per barrel target, and fresh conflict in the Middle East beginning to show its effects – to name a few.

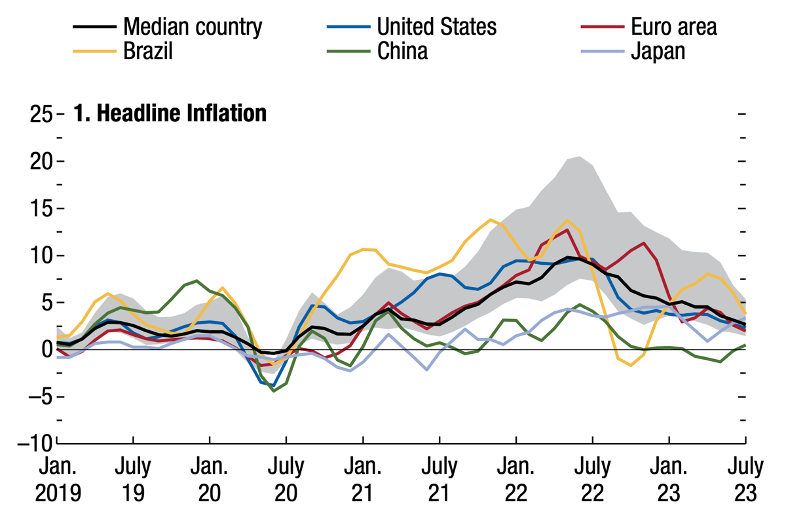

Amongst this backdrop, there has been a swathe of good news for some of the largest global economies, for example, inflation is cooing towards target levels in almost all regions, and in the US, jobs data has continued to be strong and there have been persistent upward revisions to US 2023 GDP growth forecasts.

Inflation was a key theme in our last Snapshot, and since then, pressures have eased and the US and UK have both moved to rate hike pauses, citing any future hikes as “data dependent”. There are signs we may have reached the terminal rate, although the narrative of “higher for longer” has echoed around the world and filtered into cooling equity prices and higher long term bond yields.

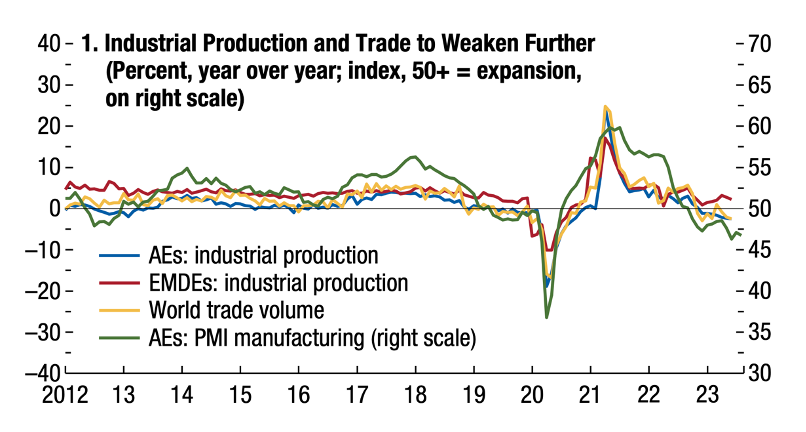

The theme of growth surprising to the upside (particularly in the US) has contributed to the rise in bond yields, and the strength of the US dollar, but expectations are for this momentum to wane and the pace of growth to slow going into the back end of the year. Specific events such as the United Auto Workers strike and student loan repayments will contribute to a loss of momentum in the US, amongst wider factors such as increasing oil prices, consumer confidence, and correspondingly low manufacturing production.

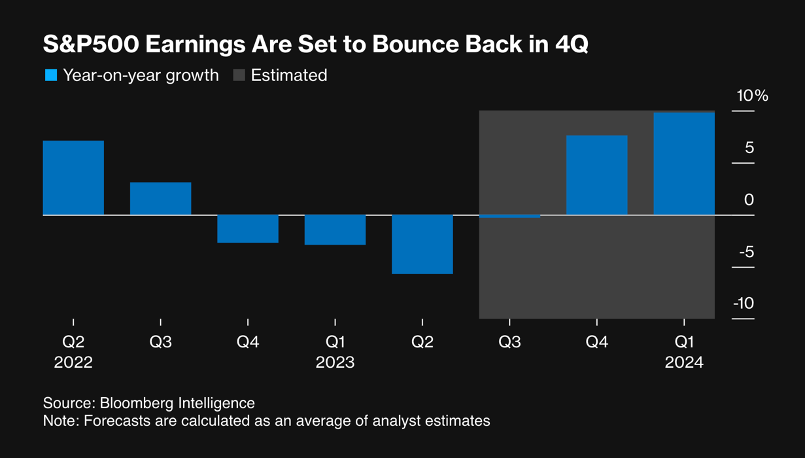

Looking at equities, the earnings recession shows signs of coming to the end and rebounding going into 2024, and with valuations having eased from their Summer highs, this could provide a fresh catalyst for growth in markets that have seen a significant correction in recent months.

Other significant factors worth considering include China facing the challenge of escalating debt and a slumping property market, possible impacts from the nascent Middle East conflict, and a state of lower global liquidity.

On liquidity, early August’s Snapshot noted that “the continuing of rising rates and quantitative tightening could lead to flat or decreasing liquidity which in the past has been seen to negatively impact risk-on markets”. This is because the inflation-adjusted returns for holding cash and cash-like investments is higher, meaning money flows from "risky" assets like stocks and bitcoin into increasingly attractive "low risk" assets like fixed income. Perhaps this could be influencing the equities and bond movements we’ve seen since the end of 2022.

Overall, the IMF states that the global outlook is “stable but slow, while risks remain tilted to the downside, but more balanced” then previously. This is a very measured statement as usual, but shows that despite challenges and uncertainties remaining, we could be on a path towards a more stable 2024.

Crypto Markets

Trading in crypto markets was reasonably muted over Q3, with trading largely following risk indices downwards in response to factors including higher bond yields and tightening global liquidity. This continues the theme from the last Macro & Market Snapshot of correlation to the downside but not the upside.

Following an approximate 10% fall in August, markets have been quiet price-wise, and sentiment has been hanging on the much-anticipated decisions over the approval of spot crypto ETFs. This flip-flopping sentiment can be seen in price action over September-October.

But why is Spot ETF approval important? Well, some believe that an approval could open the floodgates to institutional and "managed money" flowing into the space, as investors would be able to allocate a portion of their portfolios to crypto with ease and with some of the world's most trusted financial institutions such as Blackrock. Of course, trusts like the Grayscale BTC offer an option, but as a trust using futures, there is a large tracking error and perceived higher risk that some may consider off-putting.

One theme that has been apparent in 2023 is the dominance of Bitcoin over Ethereum and other altcoins. This is a common occurrence in bear markets, as holders shy away from higher risk coins and speculation. In this instance it seems many feel that catalysts are centred around Bitcoin specifically, including Spot ETFs. This has led to Bitcoins market dominance reaching multi-year highs and a tumbling ETH/BTC chart.

The launch of Ethereum Futures ETF at the start of October, which saw limited demand provided little boost, with initial volumes at only 0.2% of the level seen when Bitcoin futures debuted in 2021. Crypto prices saw some upward movement going into the launch, but this was soon reversed.

One notable outlier is Solana, where the dev community continues to release significant upgrades which have been warmly received, including the Solana Mobile Stack and Saga Web3 Phone.

Still, there are many positives overall, with the crypto market having stabilised since the numerous shocks (DeFi hacks, platform failures, regulatory uncertainty) that was prevalent in 2022-2023.

With Spot ETF approvals still pending, and Bitcoin halving coming up in May 2024, it seems many people are waiting

State of DeFi

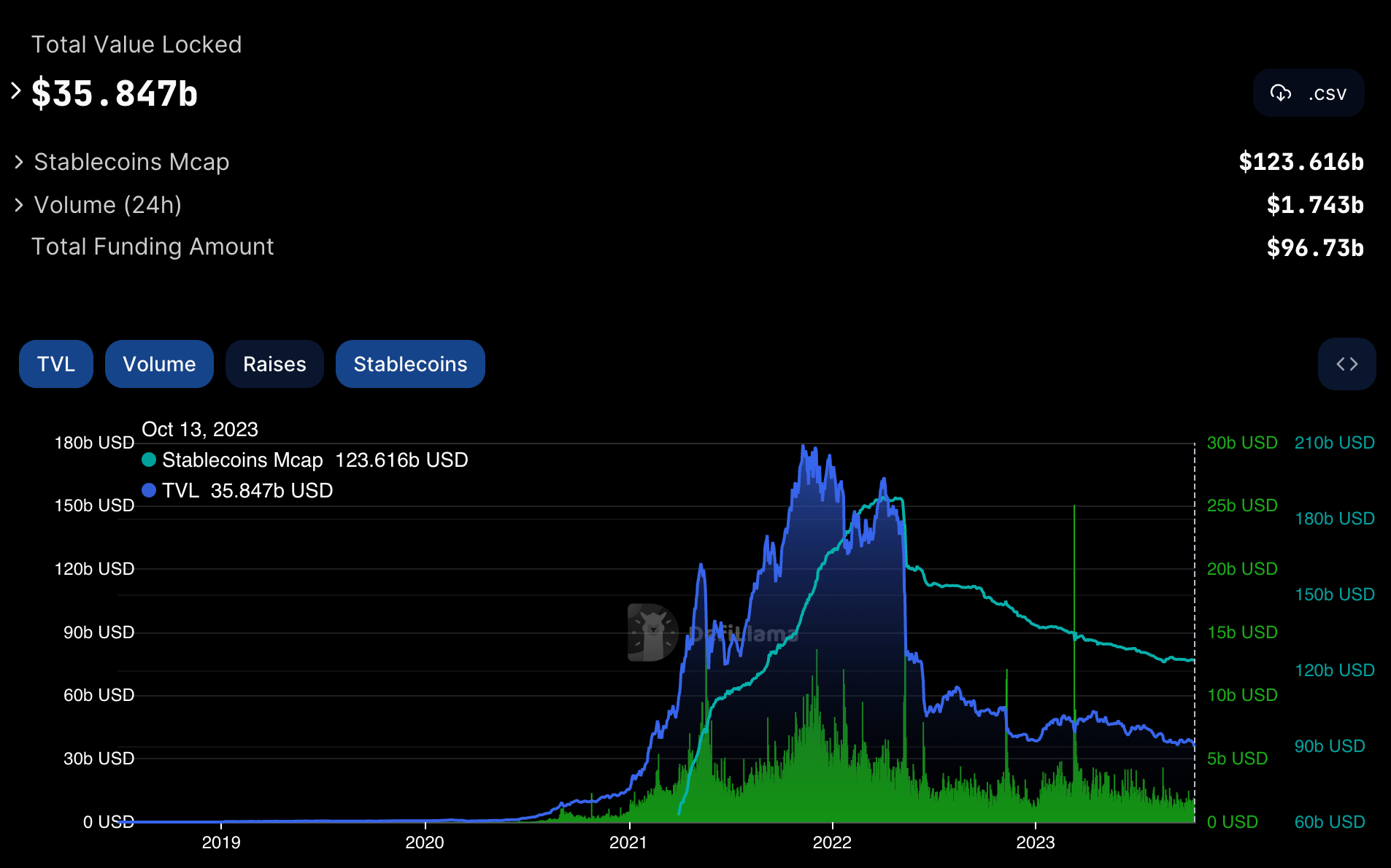

The amount of capital locked on DeFi protocols has continued to decline through 2023, coupled with gradually shrinking stablecoin market capitalisation and DeFi volumes.

There are a number of obvious factors including the fall in prices and volumes seen across the board in crypto and tighter global liquidity, as well as a spate of high profile hacks and platform failures that have led to many former users exiting the space due to perceived higher risks.

On the right hand side of the Risk:Reward balance we're also seeing lower DeFi yields, with Ethereum staking offering approximately 3.3%. Combined with higher rates in traditional finance products such as bonds, money market funds and savings accounts, the incentive to be using "higher risk" DeFi protocols is further decreases.

Despite this, certain new developments still generate hype and volume, for example "liquid staking", new blockchains, and decentralised tokenisation of real world assets, however the available size is lower than previously and yield opportunities don't seem to persist after the initial phase.

Will there be a new catalyst to reignite interest in DeFi and capture the attention of the cryptosphere again, or will it take time to rebuild trust and bring in a new wave of users? We will have to see.

In the Centralised Exchange (CEX) space, however, there are still many delta-neutral yield-generating opportunities, as shown from a quick glance at the Basis Trade Engine dashboard. And with the Basis Trade Engine adding new features ready to capture this yield with just a matter of clicks, users can continue to benefit from these even through this long downturn in the broader market

Opinion: Bull or Bear?

Now, at Basis Markets DAO, the focus is all about delta-neutral trading, and this isn't going to change, but an interesting piece of analysis caught our eye recently,

This infographic from @ecoinometrics shows the difference in monthly returns during a bull or bear market, with Orange dots for Bitcoin (of course) and Pink dots for Ethereum, split by "bull market" or "bear market".

I wouldn’t wait for a clear signal that the bull market is back to take a position on Bitcoin or Ethereum.

— ecoinometrics (@ecoinometrics) October 5, 2023

When you compare the distribution of monthly returns in bull and bear markets, the difference isn’t striking.

You can get great months during bear markets.

You can get… pic.twitter.com/7qCCPM3PYa

Not surprisingly, a reasonable normal distribution os seen in both, but whilst the distribution of monthly returns looks similar, it highlights a number of interesting details.

Firstly, the cluster of data points is more centralised around the mean during bear markets, which seems consistent with lower volatility in these periods.

Secondly, During bull markets, we see a longer "tail" to the positive side of the scale, reflecting momentum effects and the overall bullish trend over the years since the launch of Ethereum (when the data used is collected from). Even if we exclude the clear outliers from the initial months of Ethereum's existence.

Overall, despite the fact that if you squint at the chart the distributions look similar, the post seems a little misleading. As traders, expected value is king, and the average returns are clearly lower than zero in the bear market section.

Of course, none of this matters if you remain delta-neutral!

Market News

A selection of recent news pieces:

- JP Morgan’s Blockchain Lead told attendees at CCData’s Digital Asset Summit in London that 99.9% of his conversations with clients are about tokenized forms of traditional financial instruments, not crypto. Link.

- UBS is piloting a tokenised Money Market Fund on Ethereum. Link 1. Deutsche Bank also plans to offer custody as well as tokenised/digital asset products. Link 2.

- A16z’s latest “State of Crypto” report shows the number of active crypto devs has nearly halved from their peak last year, from 36,500 to 19,630. Link.

- Solana's v1.16 update brings native support for private blockchain transactions, enhancing user privacy. Link.

- Bitcoin's market dominance approaches multi-year high, with Spot ETF applications drawing attention from Ethereum and other altcoins. Link.

- New tattoo machine can ink your arm with an NFT, allowing artists to collect royalties. Link.

Education: Project Documentation Refresh

Projects evolve over time and Basis Markets is no different. With regular developments across all aspects of the ecosystem, the DAO wanted one central place they could use as a point of reference.

The documentation on the project’s GitBook page has now been refreshed to cover all the key information community members want to know. This includes information, access guides, and walkthroughs across the following areas

- Basis Markets

- BTE & BTX products

- Community

- Governance

- Access tokens

Documentation also includes a section on frequently asked questions, educational material and all official links, as well as the all-important Terms of Service and Privacy Policy.

The Gitbook will be kept up to date as new features and updates are released, as well as in response to feedback from the community.Check out the refreshed documentation for yourself at this link.

DAO Updates

Recent developments include:

- BTX version 0.4.0-beta launch, including integration of Bybit and KuCoin funding rate and orderbook data feeds into the BTX, allowing long and short trades to now be shown across exchanges, with full integration and execution coming soon!

- New DAO platform tested and launched which incorporates registration, voting and results in one place.

- Project documentation refresh, covering all the key things users might want to know about the project, including information, access guides, and walkthroughs.

- Numerous bug fixes across the BTE, BTX, and DAO platform, with huge thanks to those who have raised tickets in #support-tickets and worked with the DAO team to identify and patch specific issues

- DAO Proposal 005 progress and registrations – the discussion and preparation phase is in progress awaiting a quorum to be reached before launching the vote.

If you’d like to hear more frequent updates, please join us in the Basis Markets Discord.

NFT holders can access the members-only area of the discord, where they can find more detail on the development of the BTX, get involved in product-related discussions, and contribute to the DAO. Find out more in the Discord Community section of the Gitbook here.

Thank You

That brings this edition of the Macro & Markets Snapshot to a close. Hopefully it’s added some insight into the world of macro, markets, futures and flows, or at least the latest developments for Basis Markets.

The Basis Markets DAO is lucky to have contributors from across the market landscape within its community. As this is still a new series, we'd love to hear what you think and get feedback for what you'd like to see covered in these Snapshots going forward.

Please head over to the Basis Markets Discord to join the conversation and contribute!

P.S. Don't forget to register your NFT for the latest DAO vote!

Disclaimer

Please see the Basis Markets Terms of Service for full details.

NO INVESTMENT ADVICE: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice, Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Basis Markets DAO or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Basis Markets DAO is not a fiduciary by virtue of any person's use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Basis Markets DAO, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS: There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains and losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security's or a firm's past investment performance is not a guarantee or predictor of future investment performance.