Project Update: Current Status, 2024 Roadmap & Key Milestones

Welcome to the latest update from the BM DAO.

The year 2024 is now well underway, and is already bringing some significant developments in both the wider economy and the crypto market.

Inflation rates have continued to stabilise as global indices continue to surprise to the upside, and crypto ecosystems have surged, led by inflows into Bitcoin ETFs, a resurgence of activity in DeFi, and a return of Airdrop & Meme culture.

With our very own Solana at the forefront of the action, and funding rates providing significant opportunities for delta-neutral returns across exchanges and platforms, the environment is right for BM to continue to build momentum and push forward in being the best place for finding and capturing delta-neutral opportunities.

This blog post takes a different format from the usual Macro & Market Snapshot, and will instead focus on the BM DAO, including recent milestones, the roadmap for 2024, and communications plans.

We’ll also highlight key upcoming releases for the DAO and the flagship products: the Basis Trade Engine (BTE) and Basis Trade eXecutor (BTX), as well as how you can get involved with BM DAO yourself.

Recent Milestones

January’s DAO townhall included a review of the project’s progress during H2 2023, which includes a whole host of updates across all angles: DAO, community, growth and development.

The images below showcase some of the highlights, and you can read more in our blog archive.

Please keep an eye on the Basis Markets social media accounts and Discord Server (Official Links) for the latest updates and information about future Townhalls.

Current State

Over the past 2+ years, Basis Markets has been building the infrastructure required to support all elements of finding, analysing and capturing delta-neutral yield via basis trades.

These can be summarised into five broad elements which comprise the bulk of the project’s technology stack. There have been additional elements along the journey which have come and gone as they have been replaced or the roadmap has evolved.

- Proprietary data pipeline

- Basis Trade eXecutor (BTX)

- Basis Trade Engine (BTE)

- DAO platform

- On-chain tooling

These are supported by building blocks across web, backend, community, social media, and many more supporting services.

Below is a summary of the five main elements:

1. Proprietary data pipeline

With both of the core products (BTE & BTX) deriving their insights from identifying and analysing delta-neutral yield opportunities across exchanges, having access to the best data is paramount to their success. The initial Basis Markets data pipeline was developed in 2021 to collect data from exchanges in real-time and aggregate these into a database for the BTE. With the build of the BTX, this has been rebuilt to be fully scalable and based on modern technologies to improve efficiency (Kubernetes, distributed queue workers, auto-healing web socket aggregators, custom data pipelines, etc).

2. Basis Trade Engine

The Basis Trade Engine (BTE) provides real-time data, insights, and analysis to support delta-neutral trading and simplify the process of identifying the best basis trades at any point in time.

The product contains four dashboards intended to provide the core information user require to explore, identify, and select the best delta-neutral trade opportunities. With the development of the BTX, the BTE will be integrated into the new data pipeline in order to improve speed and efficiency.

Read more in the BTE Documentation.

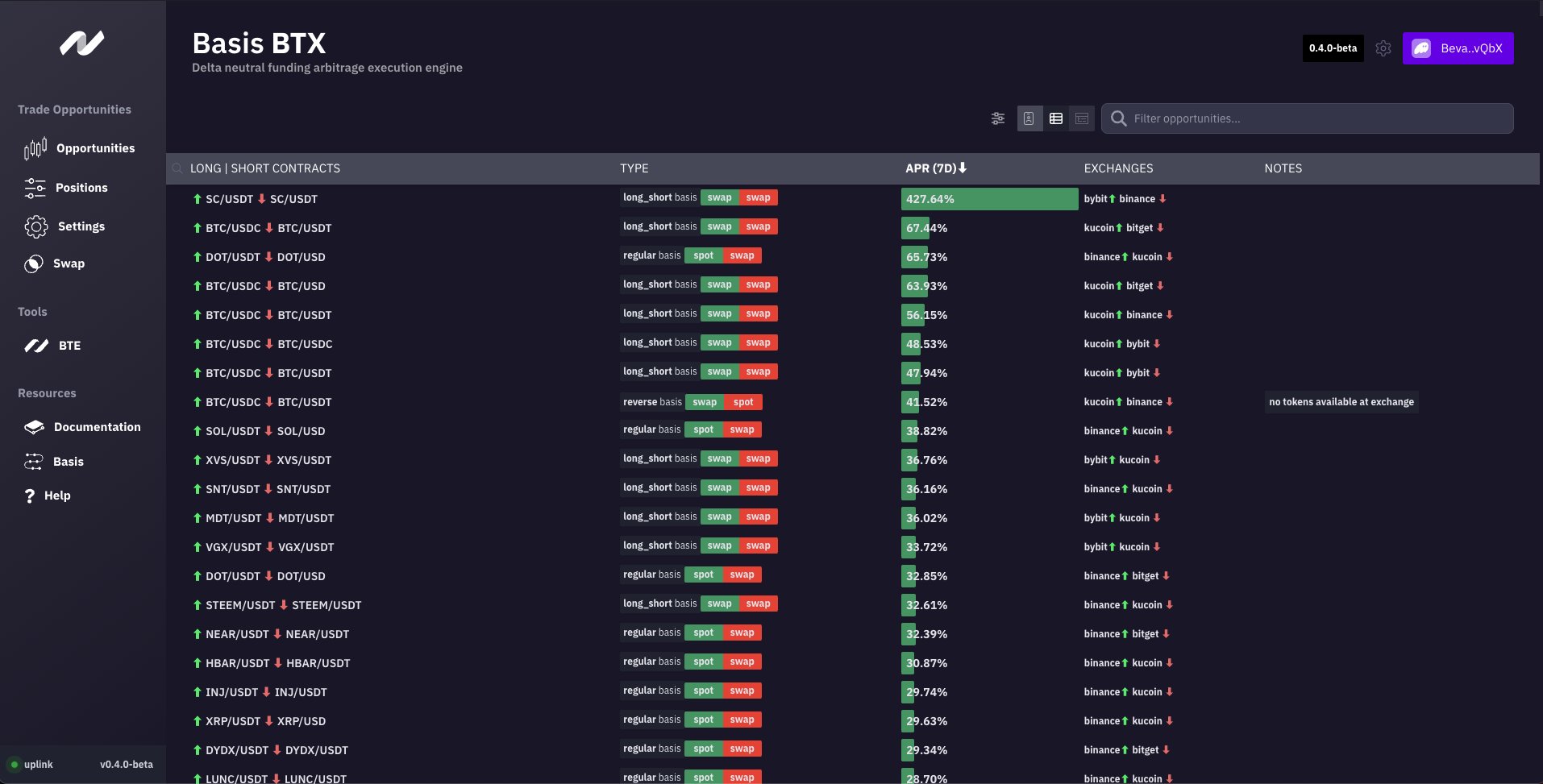

3. Basis Trade eXecutor

The Basis Trade eXecutor (BTX) is the most advanced product in the Basis Markets ecosystem, providing everything that users require to explore, identify, select, open, and manage the best delta-neutral trade opportunities.

The product is centred around a real-time list of opportunities, collated from supported exchanges, as per the Basis Trade Engine. However, the BTX goes one step further and integrates a trade execution platform, allowing you to securely connect to your accounts at top exchanges and execute trades automatically via API.

Read more in the BTX Documentation.

4. DAO Platform

Basis Markets’ governance process is based on the DAO Governance Framework and an active community of NFT holders who comprise the voting population. When a proposal is submitted to the community, it proceeds through a gated governance process, with voting taking place through the DAO Platform.

5. On-chain tooling

The project has developed and tested a wealth of smart-contract primitives and structures, as well as several prepared integrations with popular DeFi protocols. These will provide the backbone for approaching DEX opportunities and integrating them with the BTX when planned centralised exchange integrations are completed.

For more detail of the services involved in each of these, please check out this post in the members only area of the Basis Markets Discord, where @CryptoBoole has shared some more details.

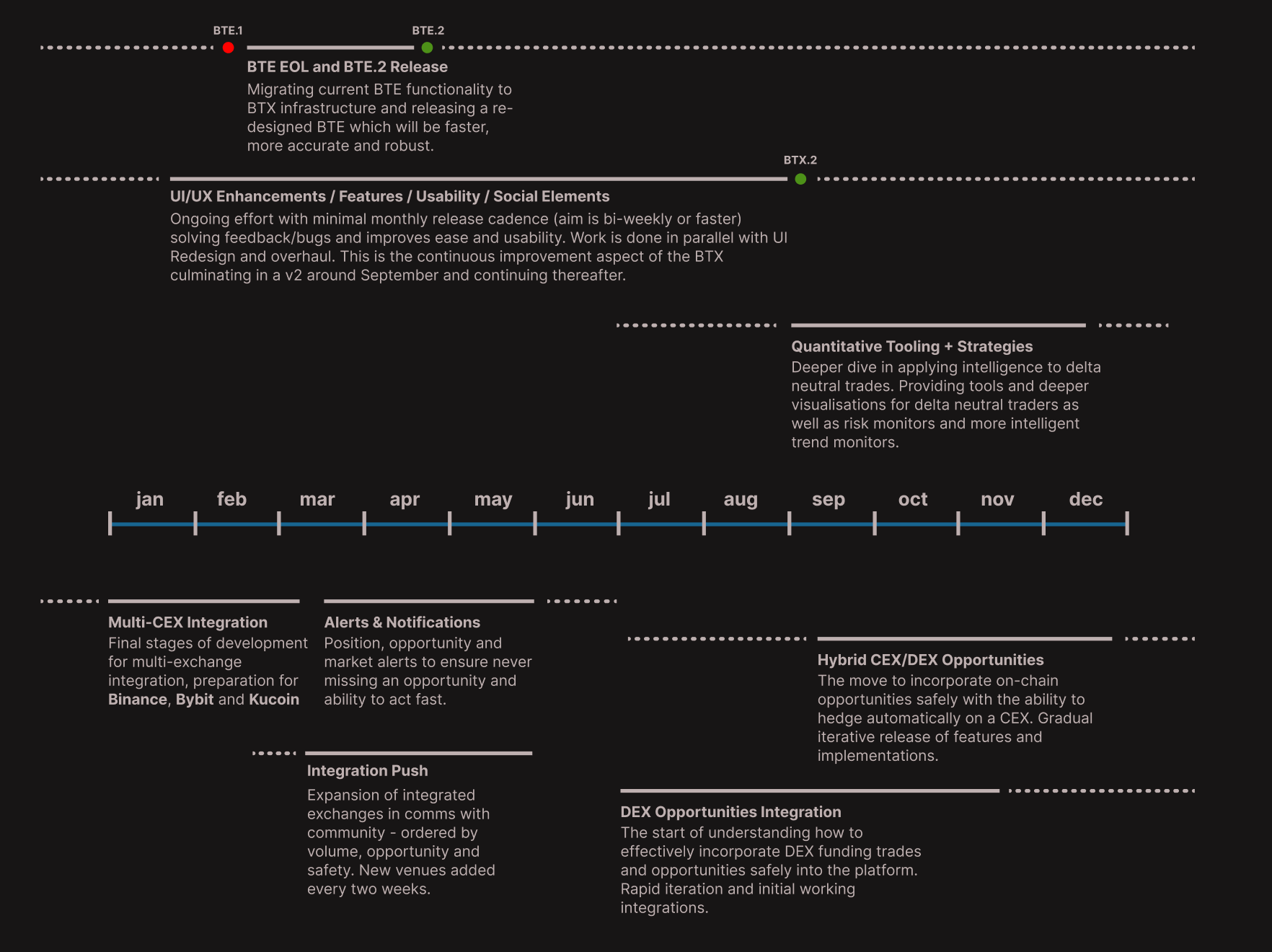

Roadmap for 2024

After numerous DAO proposals and a period of development focussed on launching and refining the Basis Trade eXecutor beta programme during 2023, the project has turned its attention towards the roadmap for 2024.

The roadmap is centred around the public launch of the Basis Trade eXecutor, but includes milestones across project areas, which all aim to build project momentum going into the next phase.

The roadmap can be summarised as follows, with more detail provided underneath:

Basis Trade eXecutor

Over the past 12 months, the project has gained valuable insight from the usage of the trade engine, and the infrastructure is set up to allow additions to be made at pace (for example, new exchange data can be integrated rapidly, and once integrated, the yield engine can immediately analyze potential opportunities.

There are 7 key milestones for the BTX:

- Multi-exchange enablement: Finalize multi-exchange execution/position management and real-time data handling by introducing an abstraction layer for seamless cross-exchange operations. The challenge is to build a resilient abstraction layer to exchange idiosyncrasies and operational differences which allows cross-exchange funding arbitrage and delta-neutral trades to function seamlessly. This is probably the most complex element of all of the Basis Markets roadmap and is in the final stages of development.

- Integration Push: Expand the number of exchanges and opportunities analysed by the BTX with data & execution integration with additional exchanges.

- Public Launch: Launch the BTX to the public, including enablement of the BASIS fee tokenomics, referral and ambassador programme as per DAO Proposals 004, 005, and 006.

- UI/UX Overhaul: Enhance the BTX user experience to provide a simplified execution process and more intuitive interface, as well as better insights into opportunities, execution, and open positions (including task status visibility and risk assessment). For example, the interface will include clear individual yield, cost, and value components to all parts of a trade as well as a live updating aggregate yield/PnL overview.

- Error management and correction: Develop a sophisticated error management system for detailed insights into partial trades, allowing for easy monitoring and intervention where required.

- Alerts and Notifications System: Implement comprehensive alerts and notifications for opportunities, trade updates (e.g. entry and exit completion/error/liquidation/funding reversal), and community events.

- Quantitative Analysis: Offer advanced quantitative analysis features using data and analytics.

Basis Trade Engine

With the focus on the Basis Trade eXecutor, the project now has an opportunity to use the new BTX data pipeline and integrations to improve the efficiency and functionality of the Basis Trade Engine. This leads to 2 key milestones for the BTX.

- Re-launch: Re-launch the Basis Trade Engine (BTE), with integration with BTX technology and a unified backend to improve efficiency

- UI/UX Overhaul: Re-design BTE dashboards to improve user experience and align with updated BTX front-end.

Other milestones

There will be many milestones along the roadmap journey including DAO Proposals, community initiatives, marketing efforts, and new opportunities to enhance the Basis Markets ecosystem of products, beginning with:

- Communications plan: Build project image and momentum through coordinated communications plan, including a weekly and monthly schedule of short-form, long-form, video, and voice comms across platforms.

- Social elements: Introduce social elements to help the community market the products and community, such as successful trades, leaderboards, copy-trading, opportunities of the day, etc. These should be integrated into the products to support project-led marketing efforts

How to Get Involved

If you’d like to hear more frequent updates and keep up to date with upcoming plans, please join us in the Basis Markets Discord.

NFT holders can access the members-only area of the discord, where they can find more detail on the development of the BTX, get involved in product-related discussions, and contribute to the DAO. Find out more in the Discord Community section of the Gitbook here.

Thank You

As we wrap up this post, hopefully it has provided some insights into the latest developments within the Basis Markets DAO and the Roadmap for 2024

All of this is thanks to the diverse contributions from our community members, whose support is continuously appreciated while the DAO keeps working towards its goal of being the best place for finding and capturing delta neutral yield.

Join us in the ongoing conversation and contribute to the dialogue by visiting the Discord.

Thank you for being a part of our journey, and we look forward to continuing it together as a DAO.

Disclaimer

Please see the Basis Markets Terms of Service for full details.

NO INVESTMENT ADVICE: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice, Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Basis Markets DAO or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Basis Markets DAO is not a fiduciary by virtue of any person's use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Basis Markets DAO, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS: There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains and losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security's or a firm's past investment performance is not a guarantee or predictor of future investment performance.