Macro & Market Snapshot: Market Review, Defi Resurgence, ETF Mania, BTC Halving & DAO Updates

Happy new year, and welcome to the latest Macro & Market Snapshot from Basis Markets DAO.

With 2023 behind us, 2024 is shaping up to be a fascinating year for the markets. This update hopes to give an insight into the global forces shaping the world of macro, markets, futures and flows right now, as well as a deep-dive into key topics and selected opinions.

DAO activity has continued to build momentum in the last quarter, and development work is the same, with regular releases and plenty in the pipeline for Q1 2024.

As usual, we’ve included a quick-fire update on the latest developments, but head over to the Basis Markets Discord & members-only area for more.

TL;DR

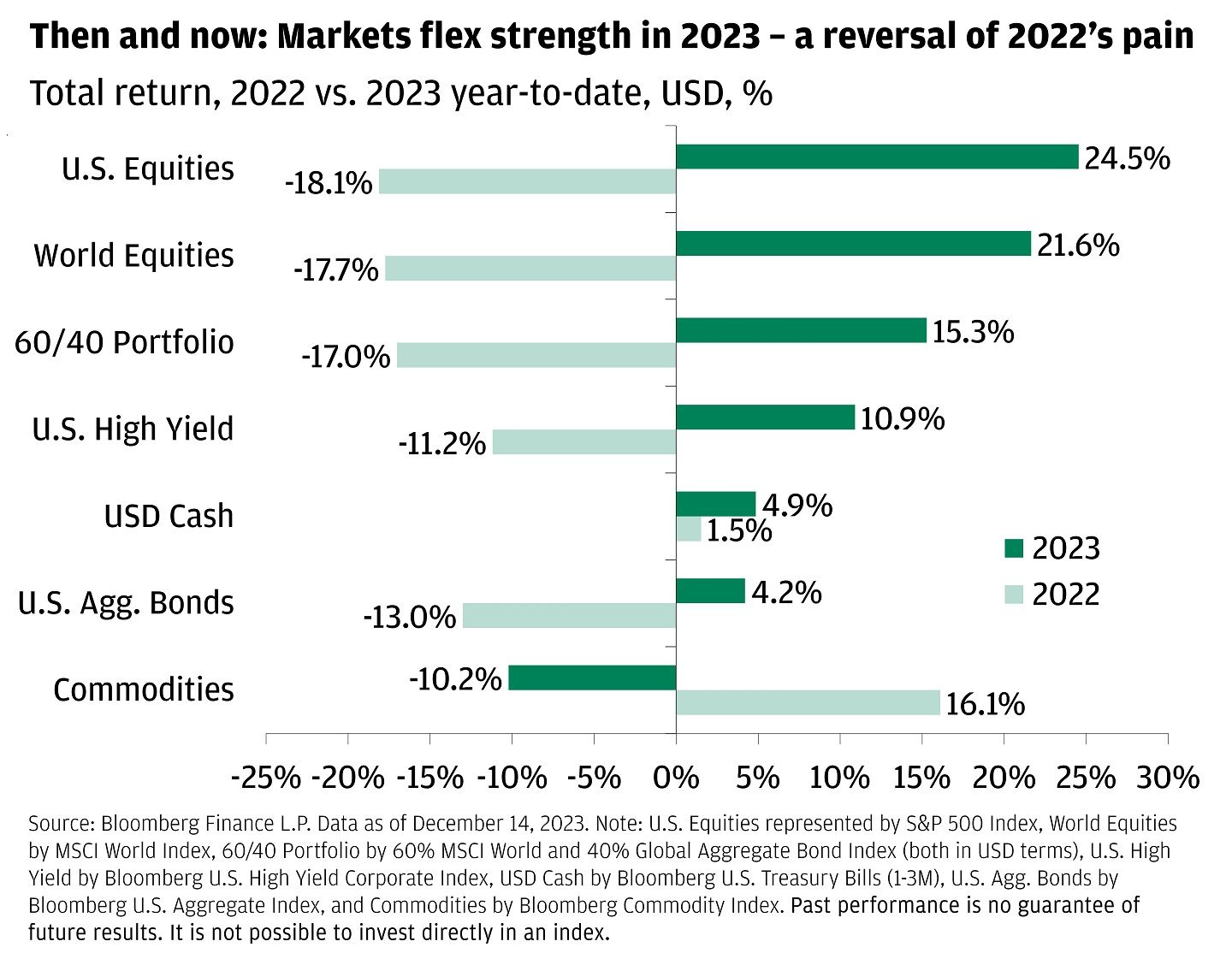

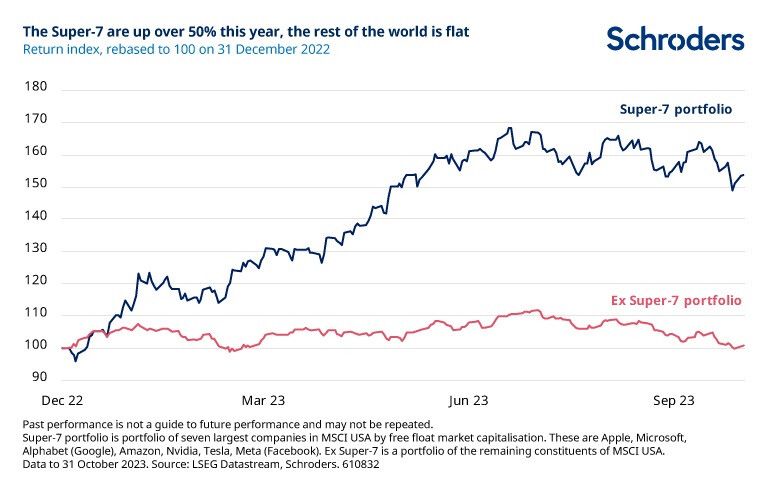

- Global indices surprised people who expected a recession during 2023, with many developed market indices were up 25+%, fuelled by tech, AI, and a centralisation of returns around large cap growth stocks (ie. the "Magnificent Seven")

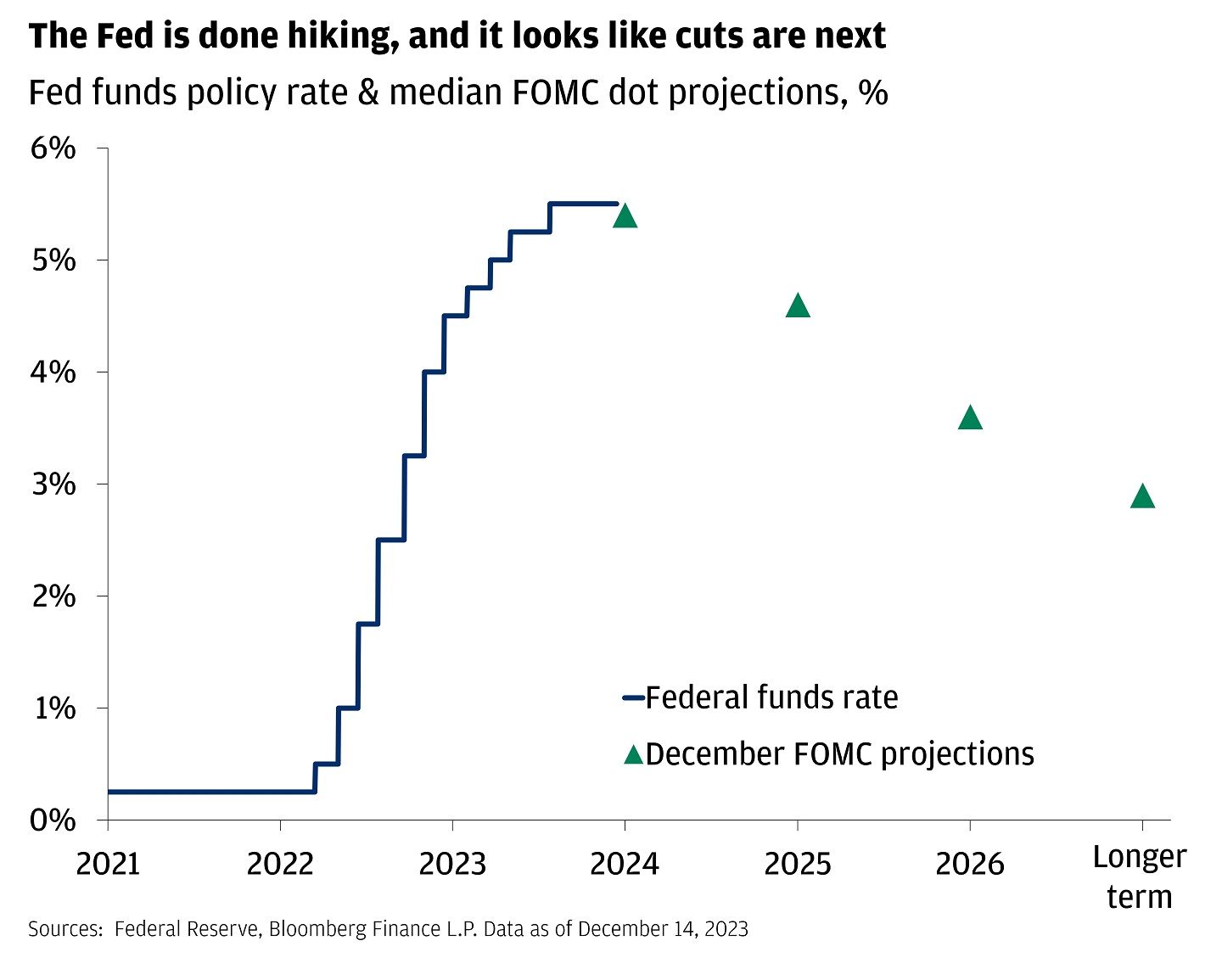

- Bond yields rose for the majority of the year, with US treasuries breaching 5% for the first time in 16 years. However, fortunes turnes around in November, with a large rally based on expectations of a monetary policy pivot.

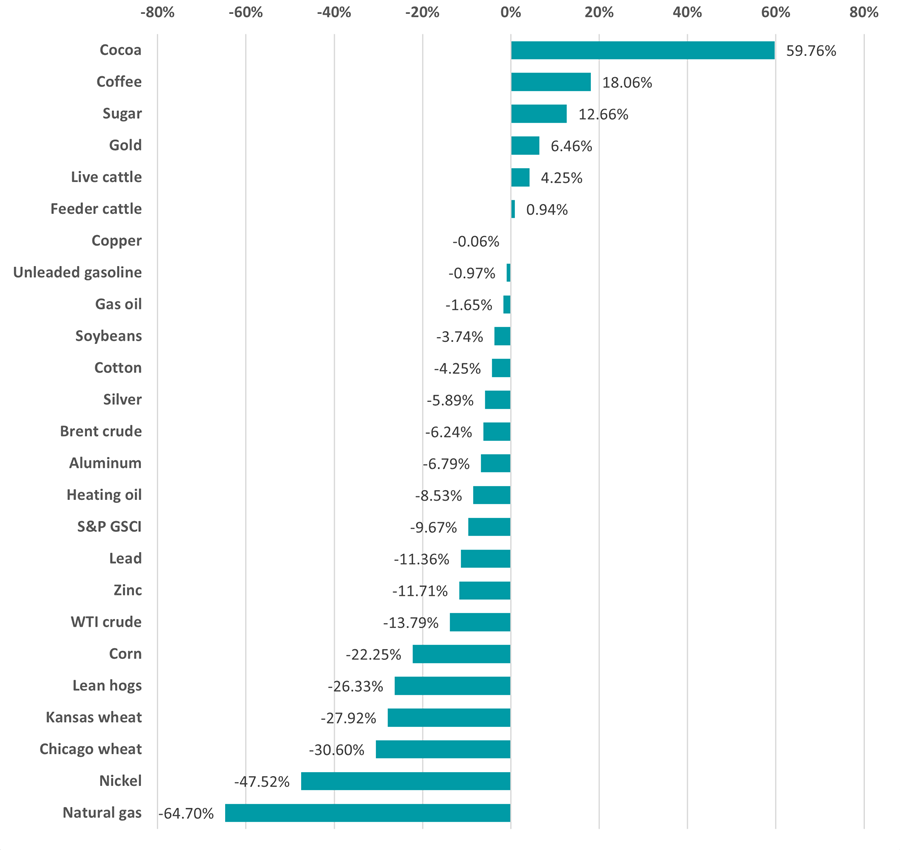

- In commodities, brent crude ended the year down 10%, despite reaching nearly $100 per barrel in September on OPEC's best efforts

- Inflation more than halved in most developed countries, and policymakers are now hinting at rate cuts as early as Q1 this year. It seems global policymakers might just have managed to walk the tightrope and deliver an unexpected soft landing!

- Macro themes for 2024 include rate cuts, moderating inflation, stabilising markets, continued geopolitical uncertainty, and AI development.

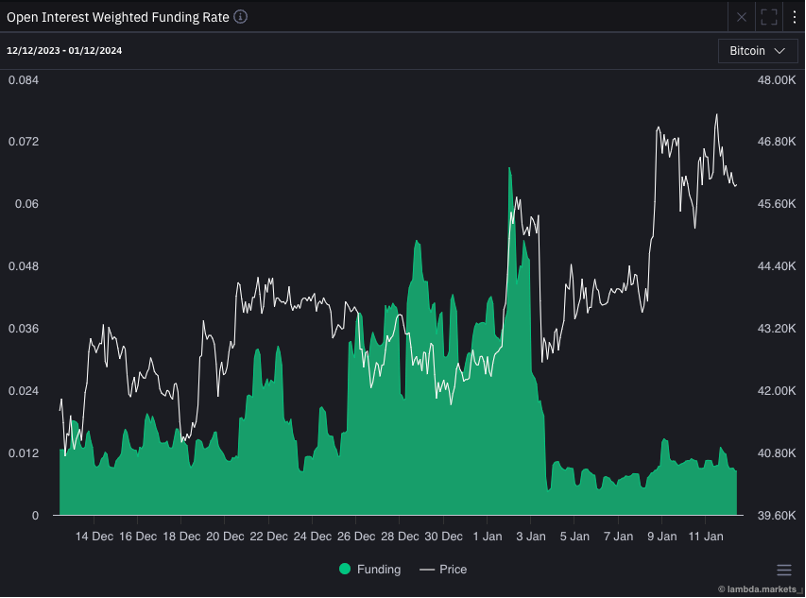

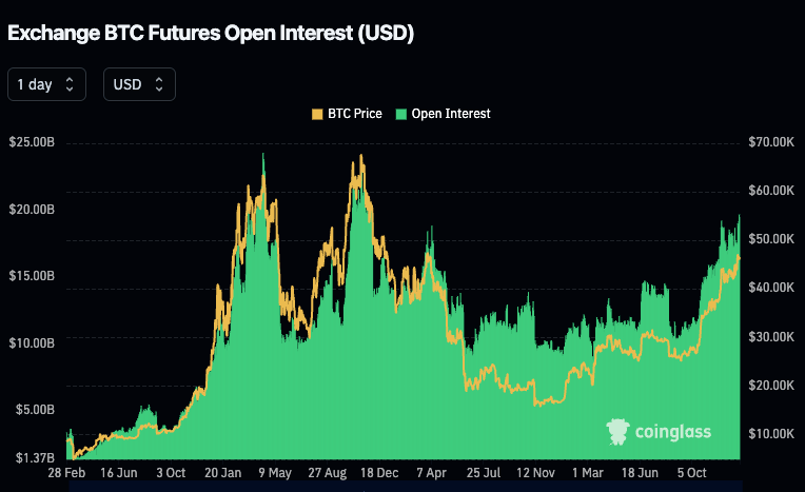

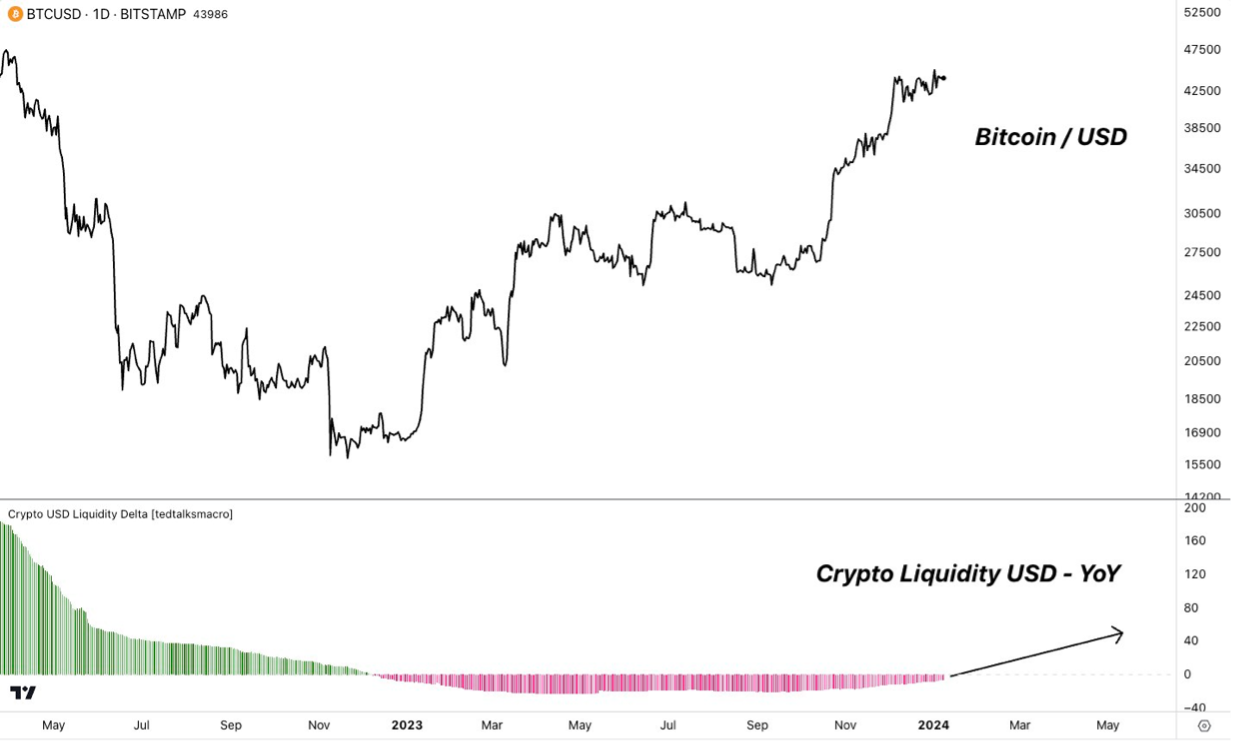

- Crypto markets have heated up, with funding rates (HELLO BTE & BTX), open interest, and market liquidity showing a resurgence fuelled by rising prices, which many ascribe to the Spot Bitcoin ETF narrative.

- Solana DeFi has seen a large increase in TVL coupled with a large spike in volume and revenue due to increased interest, higher DeFi yields, airdrops, etc as well as general crypto market buoyancy.

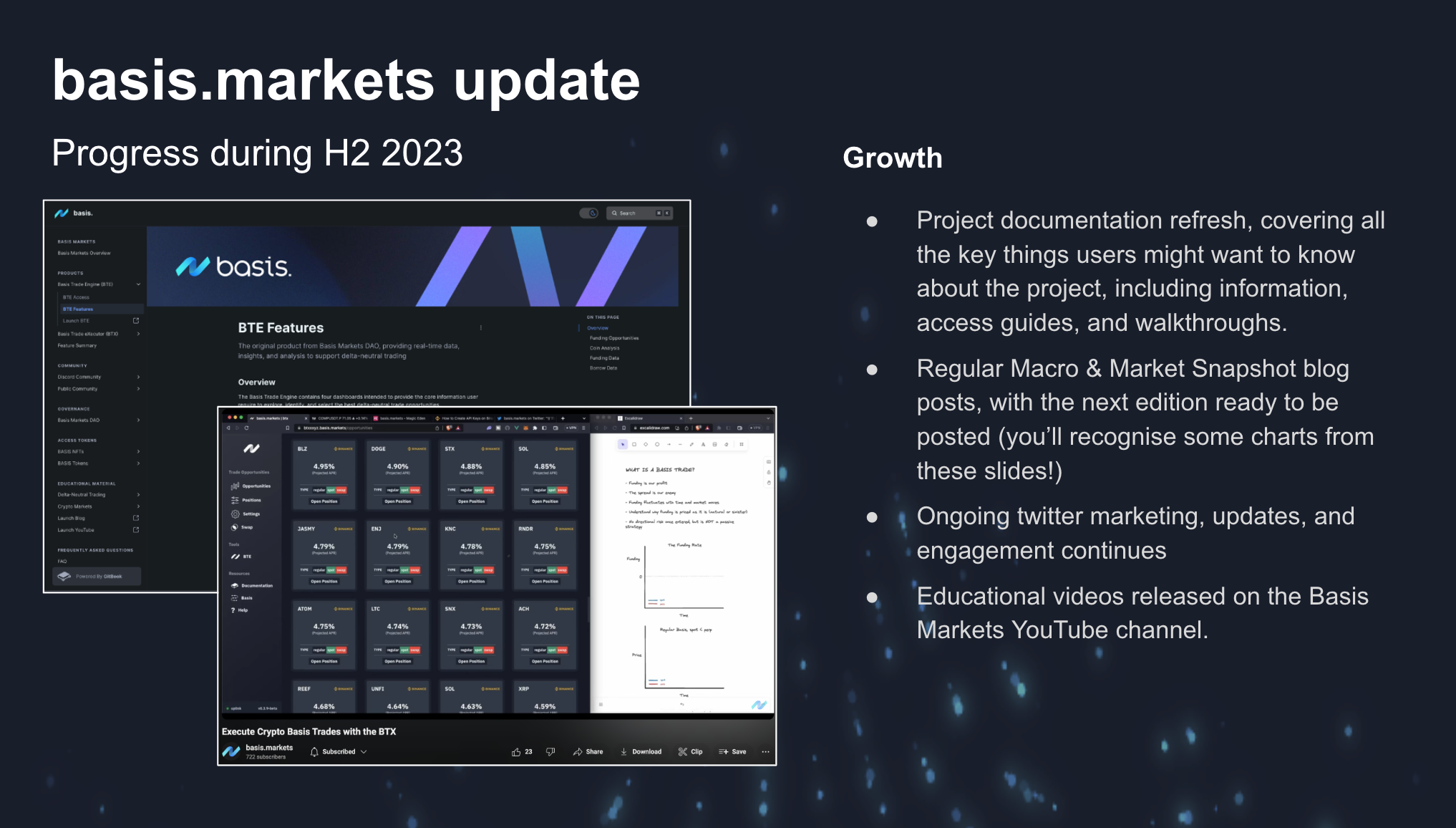

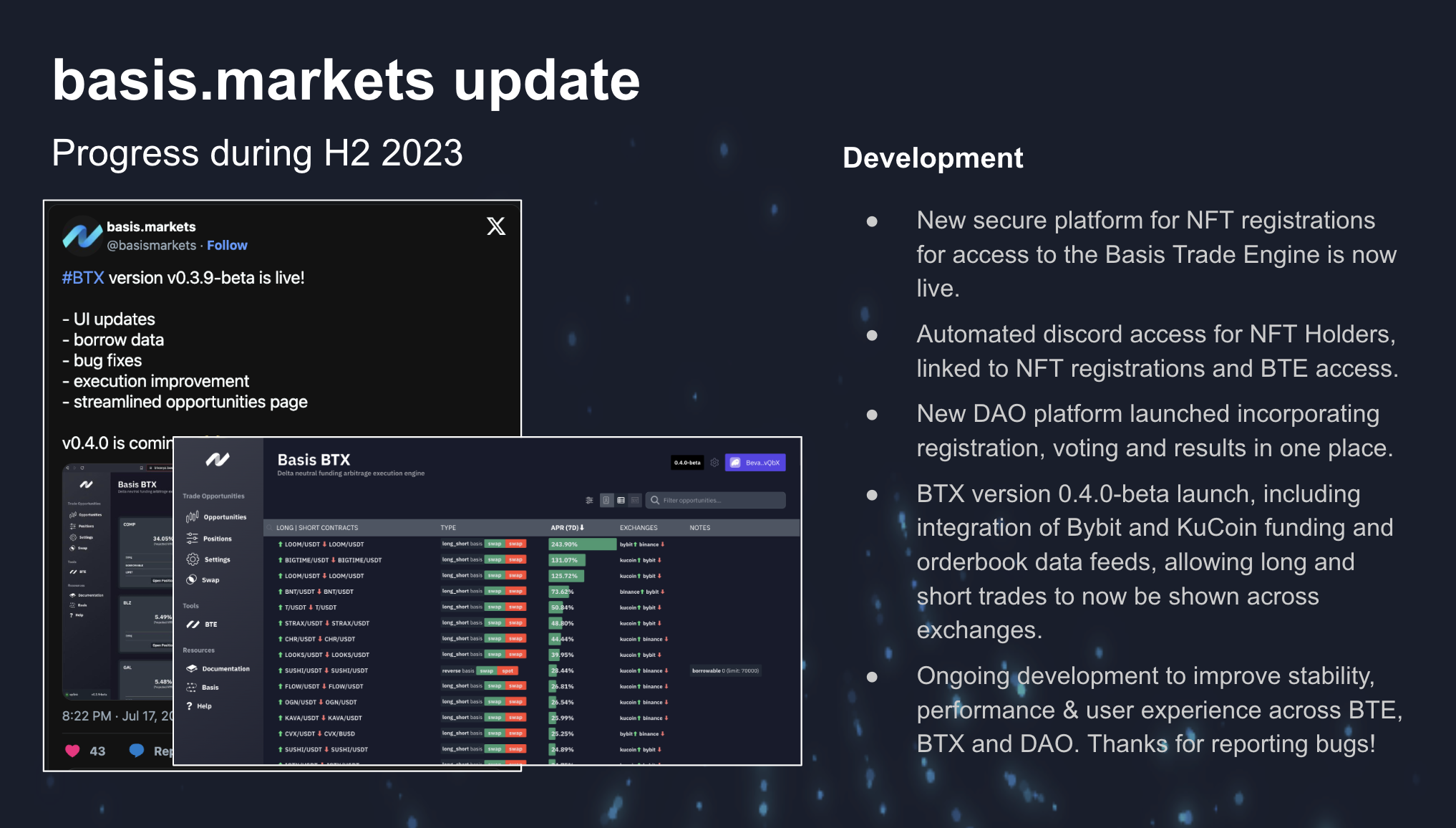

- Basis Markets DAO recently hosted a town hall with a review of the project’s progress during H2 2023, which includes a whole host of updates across all angles: DAO, community, growth and development.

- Please read on for more...!

Macro environment

The financial landscapes of 2023 proved to be an unpredictable journey, defying the gloomy predictions that shrouded the beginning of the year. In many ways, it was a year that reversed the fortunes of a tough 2022.

From unexpected stock market rallies to fluctuating commodity prices and transformative shifts in inflation dynamics, let’s dive into the highs and lows that defined the global macroeconomy in 2023.

Global indices

At the start of the year, many investors were anticipating a decline in corporate earnings, fearing a drag on the global economy from high borrowing costs. Geopolitical uncertainties loomed large, casting shadows over the markets. Yet, amidst this economic unpredictability, 2023 played out differently than expected.

Stock markets worldwide experienced notable shifts. European indices performed averagely, despite their economies nearing recession territory. While markets anticipated a boost in Emerging Market, specifically Chinese growth post-Covid reopening, a year after zero-Covid measures ended, China faced unexpected deflation and a worsening property crisis.

Wall Street strategists collectively predicted a down year for the S&P 500 – the first time since 2000. However, US markets defied the odds, with the S&P finishing the year with a c.25% gain and the Nasdaq c.45%. Firms associated with artificial intelligence (e.g. Nvidia) were particularly successful as investors recognized the technology's potential.

But gains this year were not even. For example, gains were driven mainly by mega tech stocks – the “Magnificent Seven”. In comparison, Approximately 70% of S&P 500 stocks underperformed the index, with about a third experiencing falls in 2023 - shifting value from Small Caps to Large Cap Growth stocks.

The fourth quarter of 2023 marked an "everything rally," witnessing the strongest November for the S&P 500 since 1980 and the Bloomberg Aggregate Bond Index since 1985. December saw a continuation of the positive momentum, with the Federal Reserve's new, more dovish-stance supporting a robust finish to the quarter and the year. The quarter underscored the continued influence of inflation and Fed policy as primary drivers of yields and asset prices.

This means we go into 2024 with positive momentum, but higher than average valuations.

Bonds

Bond traders weathered a challenging 2023 as concerns over central banks raising interest rates dominated. Bond prices weakened, reaching historic lows in October, with US Treasury rates exceeding 5% for the first time in 16 years.

This led to a potential third consecutive year of losses for bond funds, which hasn’t happened for over 40 years.

However, a dramatic reversal occurred in November, driven by rising optimism about easing inflation and potential rate cuts. Investors flocked to treasury bonds, triggering an extraordinary two-month, nearly 10% rally in the Bloomberg Global Aggregate Total Return Index, the strongest since 1990.

The question this year will mainly be down to Fed policy, currently the market expects 5 rate cuts this year, with the first as soon as March!

Commodities

Commodities, notably oil, experienced a tumultuous journey in 2023. Fears of a global downturn pushed prices down, while concerns about geopolitical tensions supported them. The spring witnessed a slide in Brent crude towards $70 a barrel, prompting OPEC to trim output.

Although this pushed prices up towards $100 in September, they weakened in the final three months before a December pickup. Despite the best efforts of the OPEC, crude prices ended the year down by about 10%.

Inflation

The inflation narrative has witnessed significant shifts. Initially elevated, inflation across the developed world more than halved, accompanied by resilient economic growth. This unexpected backdrop prompted the Federal Reserve to signal a pivot in its final policy meeting of the year. Policymakers hinted at more rate cuts than anticipated in 2024, indicating a shift from their earlier commitment to rate hikes.

It is hard to achieve a soft landing, and some commentators still forecast a recessionary period ahead, but it seems that global policymakers might just have managed to walk the tightrope and deliver the unexpected.

Themes for 2024

As we step into 2024, there are some key macro themes to keep an eye on:

- The Fed is expected to conclude rate hikes, with cuts potentially starting as early as March, with an end to quantitative tightening potentially also on the agenda

- Global inflation continues to fall, and economic growth moderates.

- International equities are neutral in valuation, whilst U.S. equities are relatively expensive

- Geopolitical risks persist, with wars and the upcoming U.S. election adds an extra element of uncertainty

- The potential boost in productivity through Artificial Intelligence (AI) becomes a focal point, with governments incentivizing specific industries.

Turning our attention to crypto, the approval of the first Bitcoin spot ETFs in the US - 15 years after Hal Finney’s classic tweet – could well bring liquidity back to crypto. On top of the upcoming BTC halving and strong narratives including Solana and Defi, add fuel to the fire for an exciting year for crypto markets.

For views from @tedtalksmacro, check out his full 2023 round-up and 2024 predictions in at the tweet below:

https://x.com/tedtalksmacro/status/1745265201942003849?s=20

Crypto markets

In the current crypto market landscape, certain indicators suggest noteworthy trends. This update focuses on three key metrics which provide insights into the market: funding rates, open interest and liquidity.

Funding rates

BTC and crypto open interest are steadily increasing, heading towards unprecedented levels. Funding rates have notably peaked, particularly with BTC perpetuals providing triple-digit APRs recently. The prevailing themes in 2023 are fostering increased market interest, offering opportunities for participants, particularly in delta-neutral trades.

Open interest

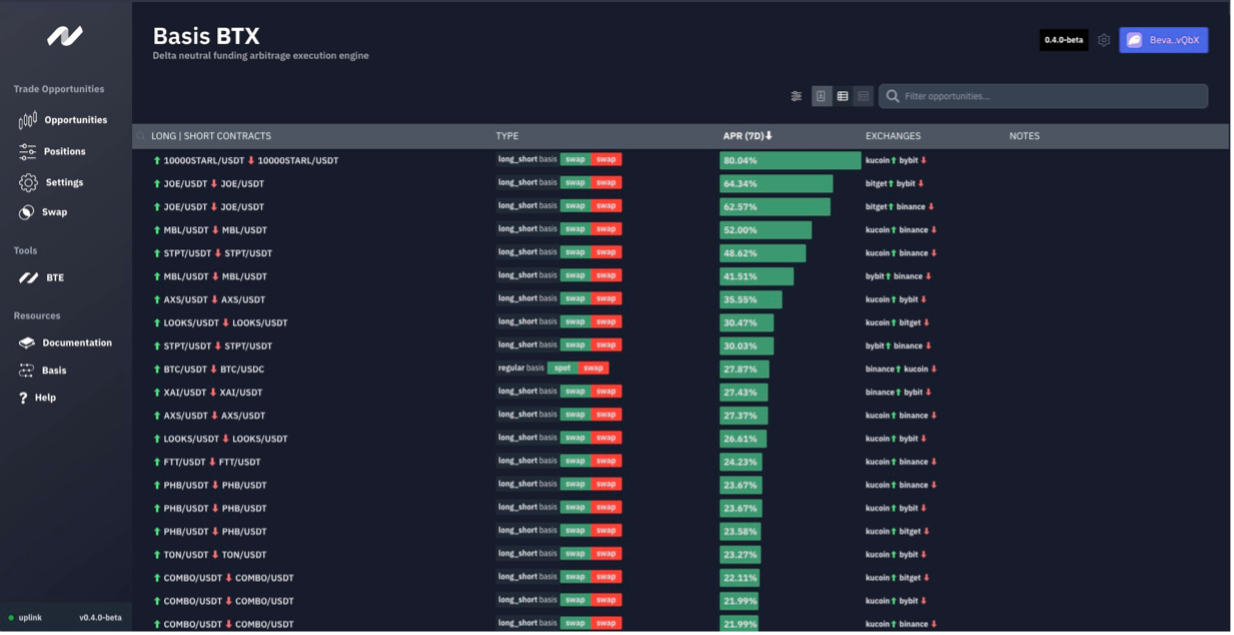

Bitcoin open interest is making a comeback, approaching nearly 25% of its 2021 highs. This resurgence extends beyond Bitcoin, with altcoins showing similar increases, indicating renewed interest in the broader crypto space. These conditions present opportunities to exploit funding inefficiencies, which is where the BTE and BTX come into their own.

Market liquidity

Stablecoin flows are rebounding on-chain, with USDC, DAI, and USDT seeing renewed interest for the first time since late 2021. As the spot BTC ETF gains traction and anticipation builds around the potential approval of an Ethereum ETF, this trend is expected to persist, reflecting renewed optimism among participants.

In summary, crypto markets are responding to many competing factors, including the three above, as well as the overall macro environment. The progress of Spot ETFs and the BTC halving event also provide catalysts for volatility.

This period is offering traders opportunities to navigate and capitalize on emerging trends. Staying informed is important to keep ahead of the trends. Specifically, the opportunity for delta neutral plays has picked up and funding rates are providing significant opportunities for capturing yield no matter the direction of prices. Check out the latest opportunities in the BTE and BTX.

Solana Defi

The amount of capital locked on DeFi protocols has started to rise in recent months, after a period of stable low levels during 2023.This has been seen across blockchains, but Solana in particular has seen renewed interest, alongside significant gains in the price of Solana.

Whilst TVL has picked up somewhat, what has been the most notable is the spike in volume and revenue generated by Solana DeFi protocols, which reached over $2bn for the first time, significantly higher than the previous peak of $1.25bn revenue in Q4 2022.

Solana as a blockchain has continued to go from strength to strength technically, building and improving through 2023 to increase its reliability, resilience, decentralisation and throughput. What’s more, protocols have been pushing the boundaries of what’s possible on Solana, with a notable mention for Jupiter Aggregator, which is changing the image of the whole Decentralised Exchange space.

On the flip-side of the Risk:Reward balance we're also seeing higher DeFi yields and incentives through large airdrop programmes. Combined with rates in traditional finance products such as bonds, money market funds and savings accounts starting to fall, the incentive to be using "higher risk" DeFi protocols is further increased.

A previous Macro & Market Snapshot noted:

“Will there be a new catalyst to reignite interest in DeFi and capture the attention of the cryptosphere again, or will it take time to rebuild trust and bring in a new wave of users? We will have to see.”

It seems things have progressed quickly: we have definitely started to see renewed interest, and we might just be on the turning point towards the next wave, watch this space.

As well as in the DeFi space, there are still many delta-neutral yield-generating opportunities on Centralised Exchanges, as shown from a quick glance at the BTE & BTX dashboards. With opportunities on both sides of the fence, there’s never been a better time to start exploring delta neutral plays.

Cryptocurrency market news

A selection of recent news pieces:

- Day two of spot bitcoin ETF trading tops $3.1 billion as Grayscale and blackrock lead. Link.

- Bitcoin's next halving could now be just 100 days away. Link.

- Bitcoin Halving 101: What it Means for Miners and Investors – a free course on Decrypt University. Link.

- Three unexpected risks from Wall Street's foray into bitcoin. Link.

- Solana Mobile to Sell Second Crypto Smartphone, a successor to Saga will have new hardware and a cheaper price point. Link.

- Jupiter sets date for JUP airdrop & teases meme token debut. Link 1. More information at Link 2.

- European asset manager coinshares exercised its option to acquire Valkyrie Funds who yesterday launched the BRRR spot Bitcoin ETF. Link.

DAO updates

The DAO recently hosted a town hall with a review of the project’s progress during H2 2023, which includes a whole host of updates across all angles: DAO, community, growth and development.

The images below showcase some of the highlights:

If you’d like to hear more frequent updates and keep up to date with upcoming plans, please join us in the Basis Markets Discord.

NFT holders can access the members-only area of the discord, where they can find more detail on the development of the BTX, get involved in product-related discussions, and contribute to the DAO. Find out more in the Discord Community section of the Gitbook here.

Thank You

As we wrap up this Macro & Markets Snapshot, hopefully it has provided some insights into the macroeconomic landscape, market dynamics, and the latest developments within the Basis Markets DAO.

All of this is thanks to the diverse contributions from our community members, whose support is continuously appreciated while the DAO keeps working towards its goal of being the best place for finding and capturing delta neutral yield.

Your thoughts and feedback are invaluable so we welcome your input on topics you wish to see covered in upcoming Snapshots.

Join us in the ongoing conversation and contribute to the dialogue by visiting the Basis Markets Discord.

Thank you for being a part of our journey, and we look forward to continuing it together as a DAO.

Disclaimer

Please see the Basis Markets Terms of Service for full details.

NO INVESTMENT ADVICE: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice, Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Basis Markets DAO or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Basis Markets DAO is not a fiduciary by virtue of any person's use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Basis Markets DAO, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS: There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains and losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security's or a firm's past investment performance is not a guarantee or predictor of future investment performance.